Invoices

Clear an old Unpaid Invoice from Accounts Receivable & reclaim the Taxes

It happens to everyone now and then: a bad debt. The big question is, how do you get it off your books, out of your accounts receivable, and reclaim the taxes you paid on it?

Basically, you will do two things:

-

Take a payment (as a Credit Memo) on the old Invoice to get it to a zero balance. This will clear it from your Accounts Receivable.

-

Create a New Invoice for the same product/order with a negative symbol in front of the quantity, e.g. -2 . Enter a payment (Credit Memo) on this Invoice; it should the same amount but a negative number this time as this allows you to reclaim your taxes on this day.

How to clear an old Unpaid Invoice from Accounts Receivable & reclaim the Taxes

The following steps will remove an Invoice from your accounts receivable list:

-

In your Invoices, locate the customer’s Invoice.

If you are selecting the customer's Invoice from the List View, then you will need to click on the purple Data Entry button to switch to the Line Item Entry screen. Otherwise, go to the next step. -

In the Line Item Entry screen, click the Enter A Payment button.

-

The Amount owing is automatically entered.

-

In the Tender field, choose Credit Memo .

If you do not see it in the list, then scroll down to the bottom of the list and click on Edit. Then add "Credit Memo" into the list, on it's own line, above the hyphen.

-

Click the Done Go To Form View button.

The full amount of the Invoice is paid with Credit Memo and the balance is now zero.

Tip: Take note of the Invoice number, customer name and item sold on this credit memo Invoice. Or print out the Invoice as you will be entering them onto the new Invoice to reclaim the taxes and zero out the 'credit memo'.

Create a New Invoice and Reclaim the Taxes

-

Create a new Invoice and enter the customer’s name or ID number.

-

Use the magnifying glass (or purple search button) to enter the Product or Work Order number so that the same item(s) appear on this new Invoice as they appeared on the old Invoice.

-

In the Qty field, enter a negative value, for example, -1 .

The item(s) and total appear in red and as negative numbers. (If this is a retail product and the number is still in the Products file, then the inventory count for the item is increased to show the return of the item. If it is a Work Order, then inventory is not be affected.) -

Click the Enter A Payment button.

-

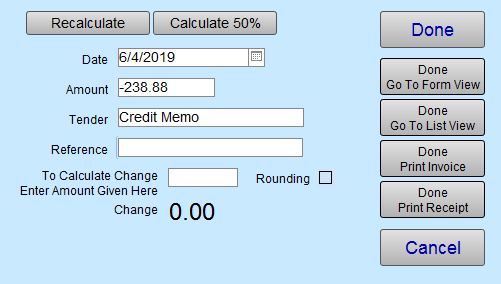

The Receipts dialog box appears. The Amount field shows a negative number.

-

In the Tender field, choose Credit Memo .

-

Click the Done Go To Form View button.

You may be asked to enter the name of the sales rep (if your program is not set up to automatically enter a name). -

In the Invoice Note field (lower left corner), enter a brief explanation of the return and identify the original Invoice number.

This will save you time at the end of the year end explaining this to your accountant or an auditor, for example, Created invoice to correct canceled order on invoice #100012 . -

Go back to the original Invoice and enter a similar note identifying the new Invoice created to reclaim the taxes.

This will generate a tax credit for you on today’s sales.

You will now have two Invoices for the same customer. Both with a zero balance.

Notes:

-

On your Sales Report, you will notice the taxes for the invoice as a negative which reclaims the amount of taxes paid. Both the monthly Sales Report and the End of Day Sales Report will look the same.

-

In the Payment Report showing your Receipts for the day, you will see the tender, Credit Memo, listed with the same amount of money being paid and removed so that the total is zero.